As a leading company in high-tech industries with high entry barriers, including aerospace, automotive, and rail systems, we combine technological excellence with a broadly diversified business model. Our four divisions combine material expertise in steel and metal production with innovative engineering expertise. With a clear growth strategy and active management, we have been continuously creating sustainable value for our shareholders since our IPO in 1995.

Investor Relations

Investing in voestalpine

voestalpine in figures

The voestalpine divisions

voestalpine combines various business models within a single group. Each model has its own requirements in terms of management and organization. That is why our business areas are grouped into four divisions that contribute significantly to the success of the company. This structure combines the strength of a global group with the flexibility of locally operating units.

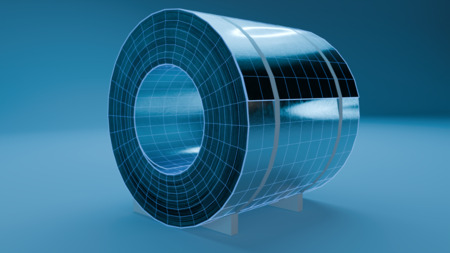

Steel Division

High-tech steel for the most demanding requirements

The Steel Division produces high-quality steel for the automotive, household appliance, and mechanical engineering industries. In the energy sector, it supplies customized heavy plate for oil, gas, and renewable energies.

High Performance Metals Division

High-performance metals

The High Performance Metals Division is a global leader in the production and processing of high-performance metals, such as tool and high-speed steel. It supplies the aerospace, automotive, and oil and gas industries, among others.

Metal Engineering Division

System solutions for rail and high-tech industries

The Metal Engineering Division is a global leader in integrated rail infrastructure systems in the Railway Systems business unit. It also offers premium wires and seamless tubes for industry and the energy sector, as well as comprehensive welding and manufacturing solutions.

Metal Forming Division

Components for demanding metal processing

The Metal Forming Division develops high-quality profile, tube, and precision strip steel products as well as system components for the premium automotive sector and other industries worldwide. It is characterized by its strong expertise in materials and processing.